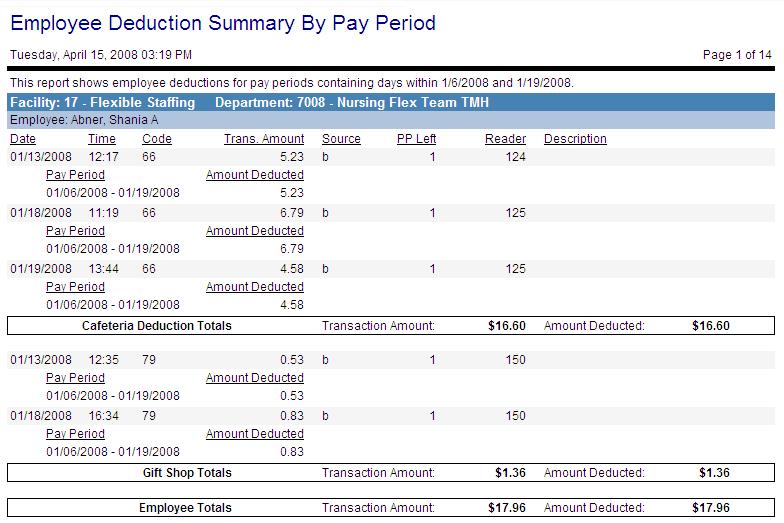

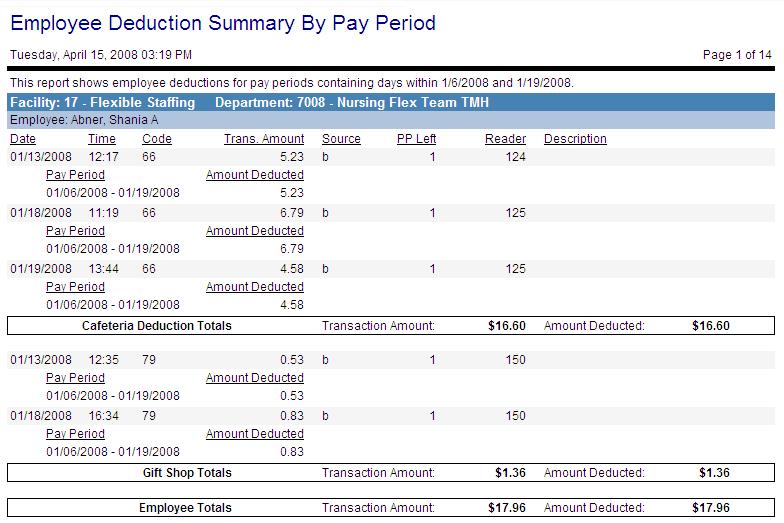

Employee Deduction Summary by Pay Period

This report lists the deduction amounts for each employee within a specified pay period, sorted by labor distribution. The heading includes the labor distribution code and description. The secondary heading and sort is by employee name. Report fields include the DeductIT description, the total of the transaction amounts for that type of deduction, and the amount deducted. Totals for each employee are included.

If the Totals Only parameter is set to No, details for each transaction is displayed, including the date, time, code, transaction amount, source, pay periods left to deduct, reader, and description.

Report parameters include the following options:

- Organization Unit: Enter the values to indicate which organization units to include in the report.

- Employee: To run this report for a single employee, click on the icon to the right of the field to open a search screen. To run this report for all employees in the selected organization units, leave this field blank.

- Job Class: To run this report for a single job class, click on the icon to the right of the field to open a search screen. To run this report for all job classes, leave this field blank.

- Totals Only: Select whether to display totals only (True), or to display transaction details for each type of DeductIT code (False).

- Pay Group Instance: Click on the icon to the right of the field to open a screen to search for and select a pay group instance.